股票市场的统计套利策略研究——基于随机森林模型与传统套利模型对比毕业论文

2020-07-06 18:15:47

摘 要

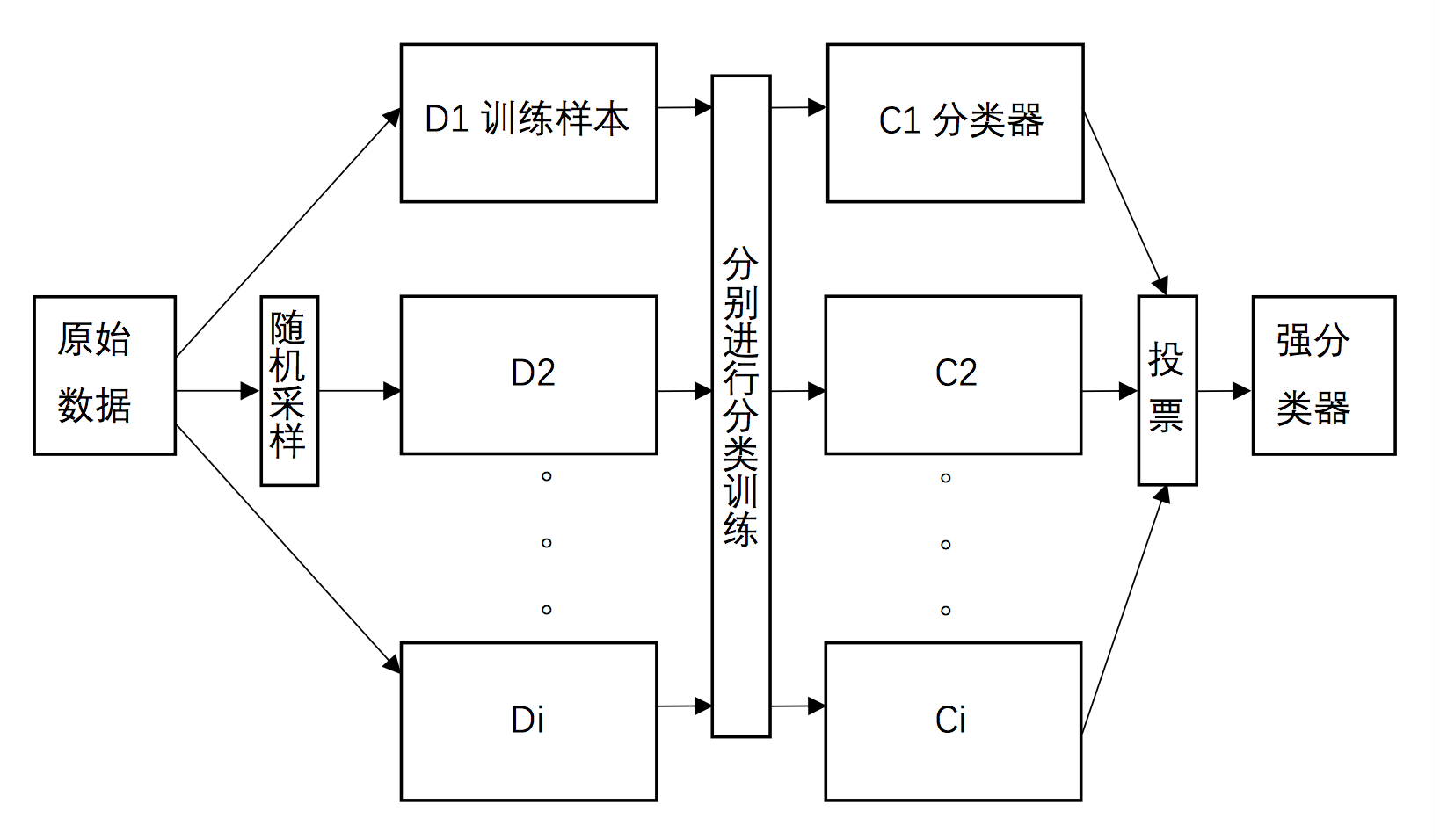

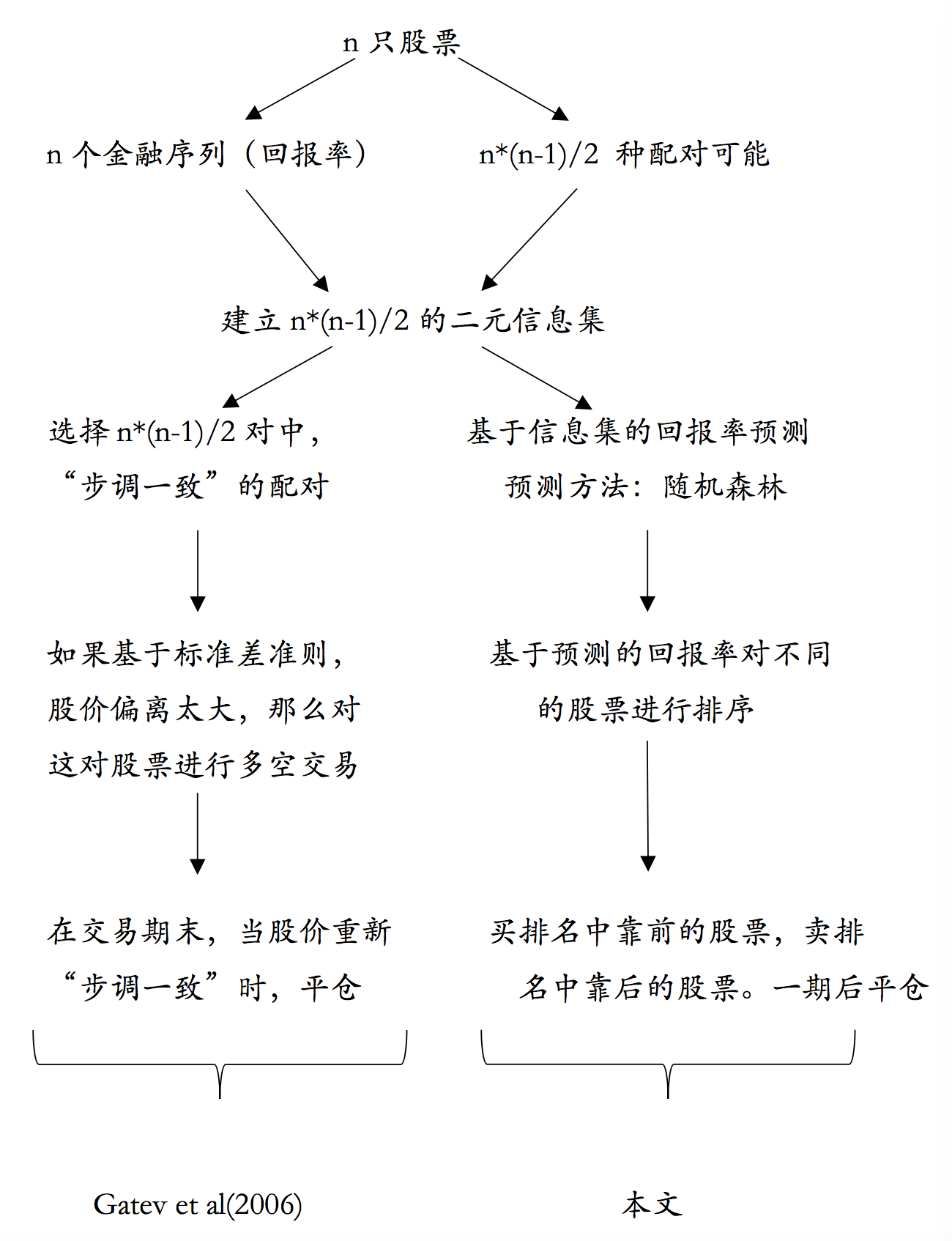

统计套利是通过对历史数据进行统计分析,从一组资产的定价偏差中获利。如何配对,如何选股是统计套利的关键之一。传统的方法是以协整理论为基础。近年来,随着对机器学习算法研究的深入,发现机器学习方法在预测方面更具有优势,于是,出现了基于机器学习算法进行统计套利的策略研究。本文以随机森林模型为基础,提出了一个整体的,灵活的,有效的配对交易策略并和传统的套利模型进行了比较。

首先,对随机森林模型的思想和传统套利方法进行总结和回顾;

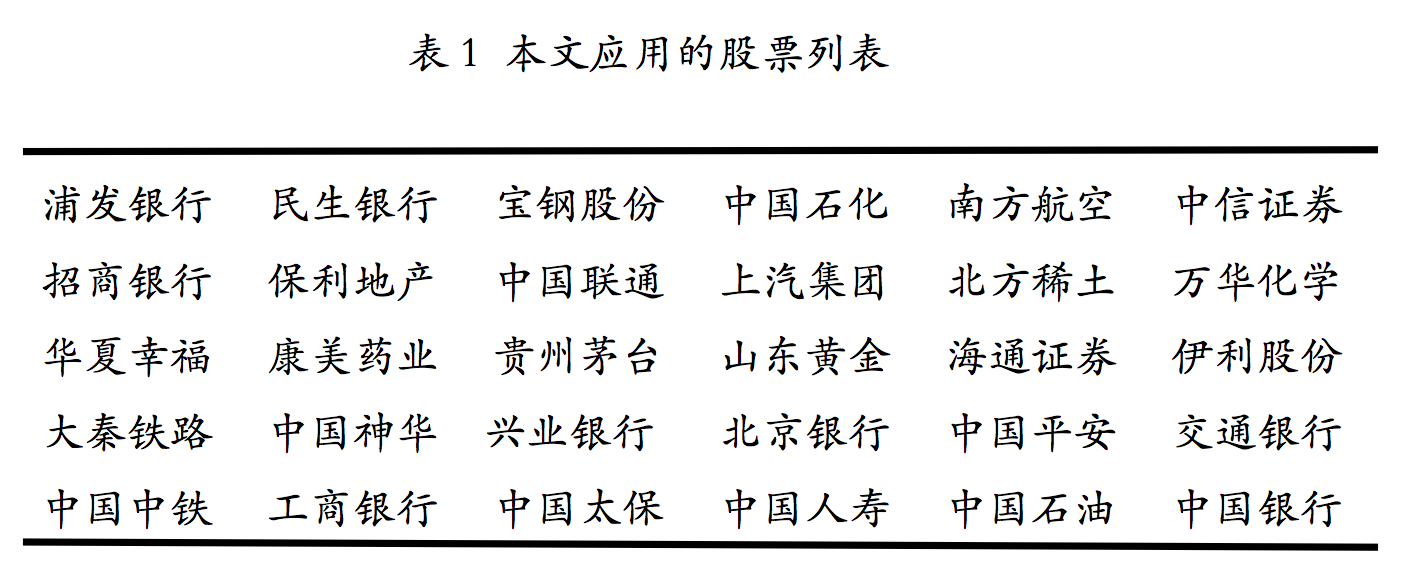

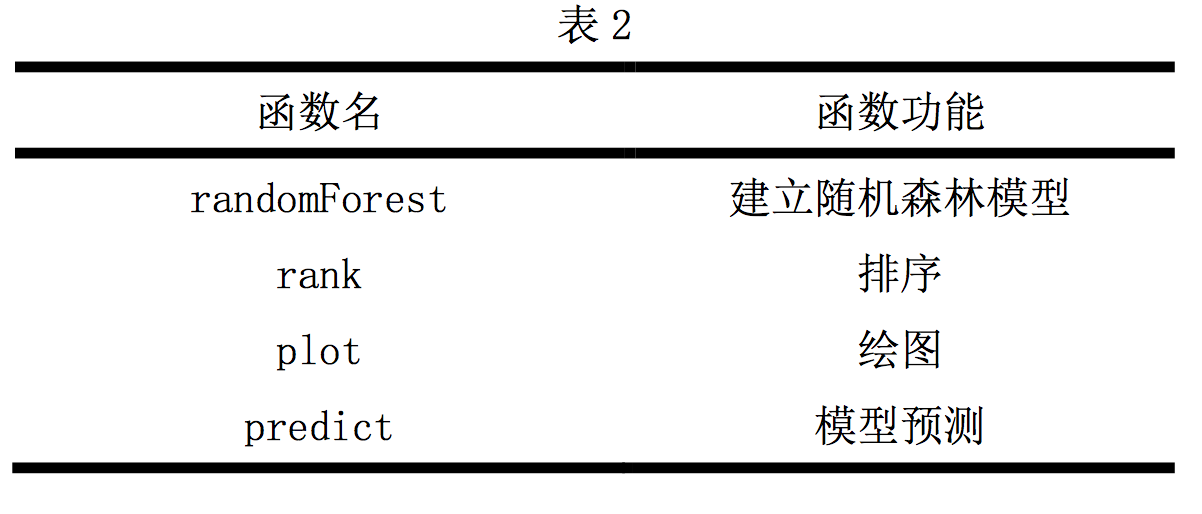

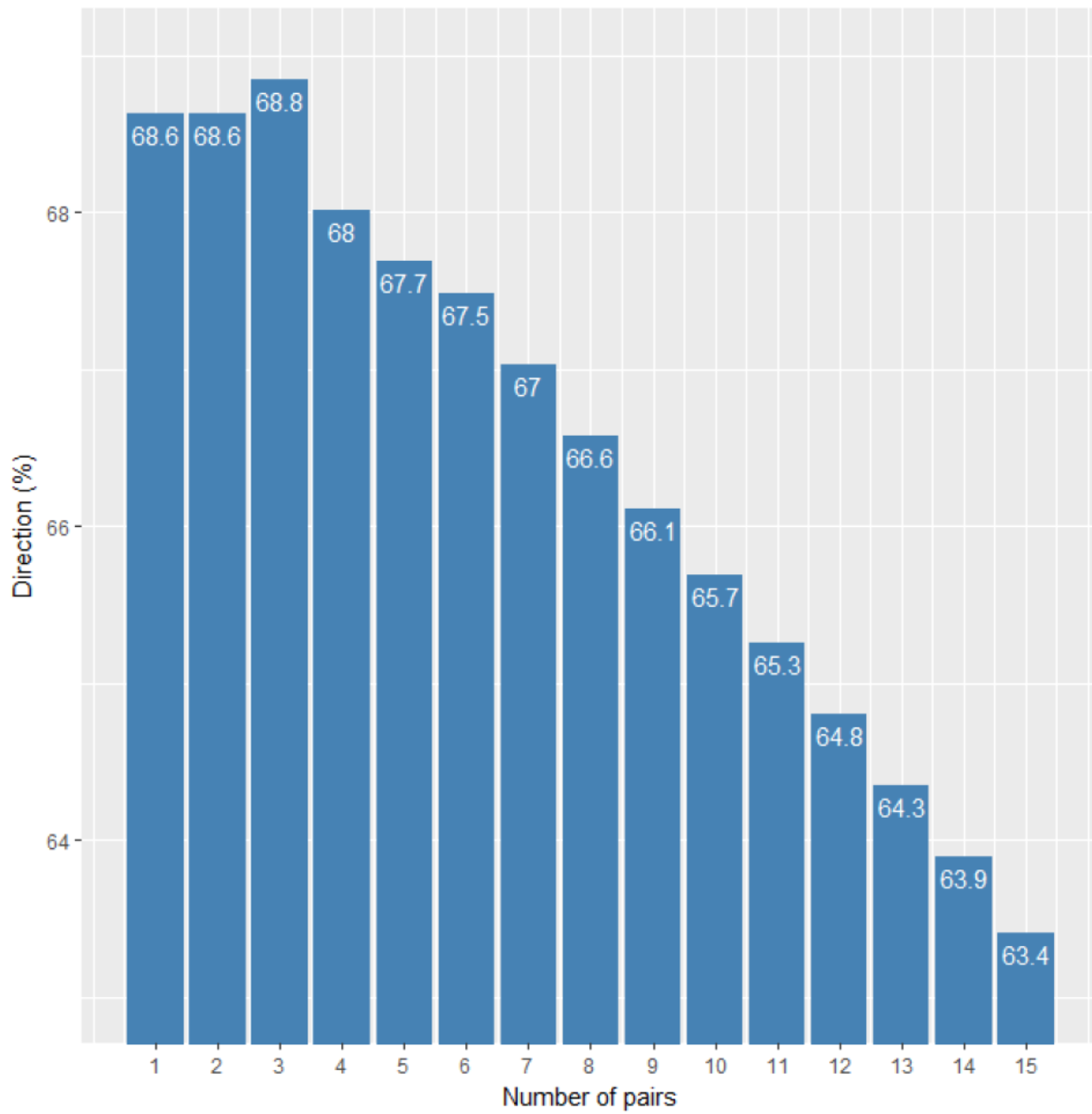

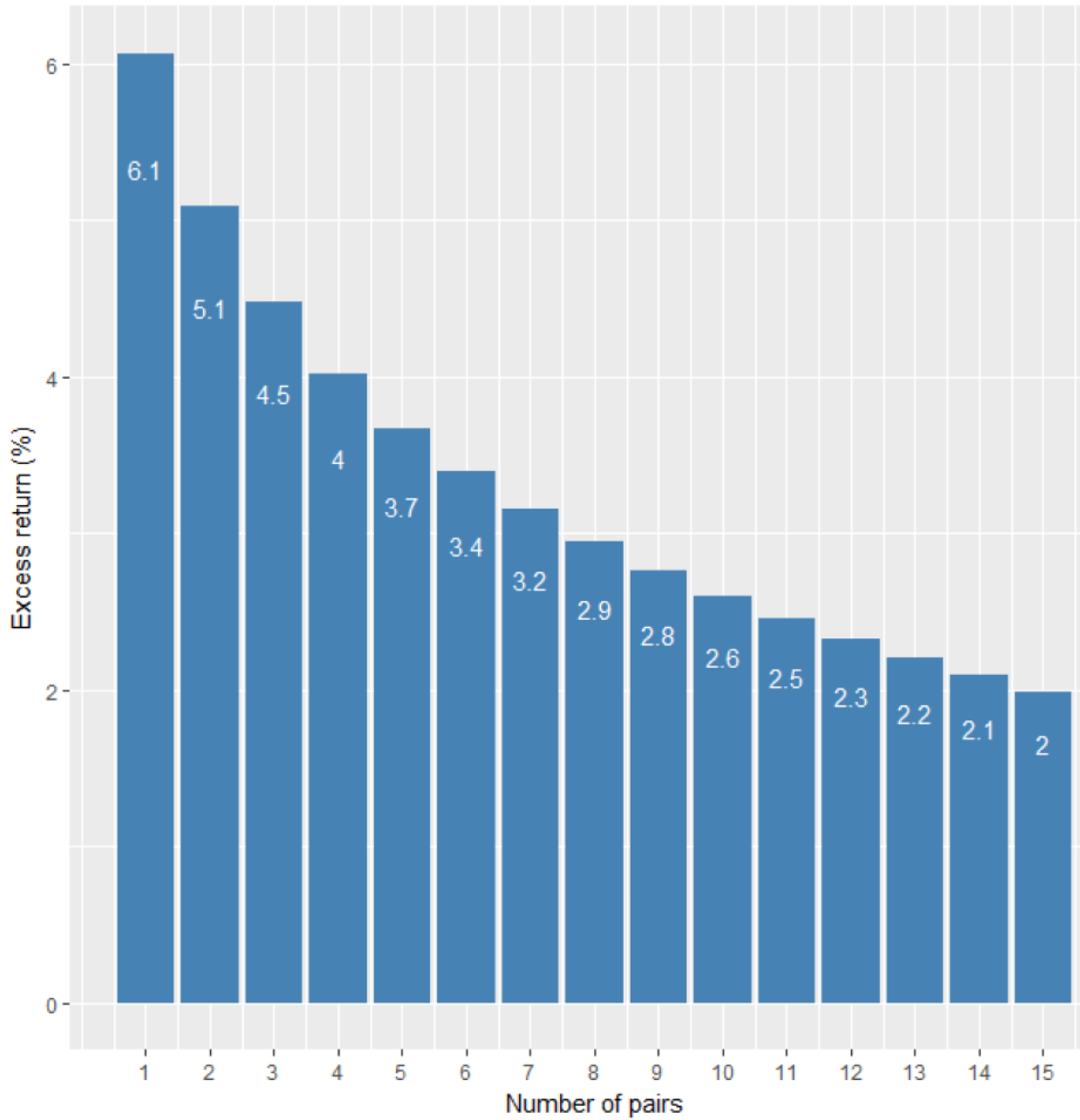

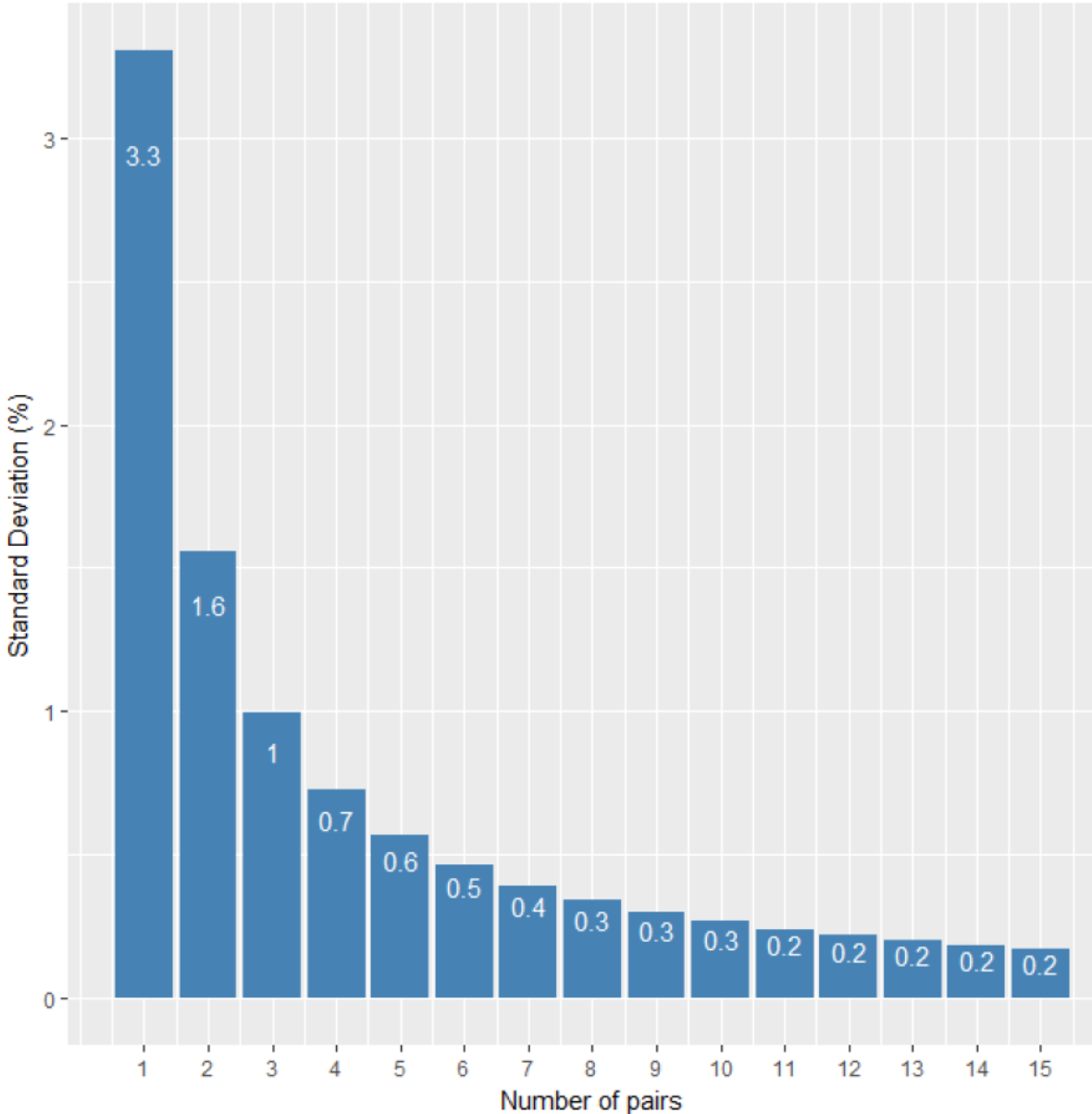

其次,以上证50指数的30只成分股为样本,基于随机森林模型,按照预测-排名-交易的整体框架研究了统计套利的配对交易策略。第一步,利用随机森林模型向前一步预测每只股票的回报率;第二步,根据回报率大小由高到低进行排列。排名高的股票在下一期表现的潜力大,排名低的则潜力小;第三步,制定策略:在交易期,买多排名高的股票,卖空排名低的股票,一期后平仓。如此循环至交易期末。评价指标结果显示:无论配对数是多少,随机森林方法的选股结果的方向精度均显著超过50%,超额收益率显著大于0,标准差也符合经典的投资组合理论。

第三,将随机森林模型与协整模型的配对套利交易策略进行实证检验。结果显示:在7期交易期内,通过随机森林方法给出的统计套利策略,无论在套利次数,套利利润等其他方面都显著超过协整模型给出的套利策略。

本文最后就提出的选股模型进行分析并提出展望,为投资者提出一些建议。

关键词:股票市场,统计套利,随机森林,协整理论

Research on Statistical Arbitrage Strategies in Stock Market

——Comparison based on random forest model and traditional model

Abstract

Statistical arbitrage is a statistical analysis of historical data to profit from the pricing bias of a group of assets. How to pair and choose stocks are the keys to statistical arbitrage. The traditional method is based on cointegration theory. In recent years, with the in-depth study of machine learning algorithms, it has been found that machine learning methods are more advantageous in terms of prediction. Therefore, a strategy of statistical arbitrage based on machine learning algorithms has emerged. Based on the random forest model, this paper proposes a general, flexible and effective paired trading strategy and compares it with the traditional arbitrage model.

Firstly, it summarizes and reviews the ideas of both the random forest model and the traditional arbitrage methods.

Secondly, the 30 constituent stocks of the SSE50 Index are sampled. Based on the random forest model, the statistical arbitrage paired trading strategy is studied according to the framework: prediction-rank-transaction. In the first step, the random forest model is used to predict the one-step-forward return of each stock; in the second step, the return is ranked from high to low. High-ranking stocks have great potential in the next period, while low-ranking ones have little potential. In the third step, formulate strategies: During the trading period, buy high-ranking stocks, sell low-ranking stocks, and close the position after one round and cycle to the end of the trading period. The results of the evaluation indicators show that, regardless of the number of pairs, the direction of the random forest is significantly greater than 50%, the excess return rate is significantly greater than 0, and the standard deviation also meets the classical portfolio theory.

Thirdly, empirically test the paired arbitrage trading strategies of the random forest model and the cointegration model. The results show that the statistical arbitrage strategy given by the random forest method in the 7-period transaction period significantly exceeds the arbitrage strategy given by the cointegration model in terms of arbitrage times, arbitrage profit, and other aspects.

At the end of this paper, the author analyzes the stock selection model and proposes the prospect, and also make some suggestions for investors.

Key words: stock market, statistical arbitrage, random forest, cointegration theory

目录

摘 要.........................................................................................................1

ABSTRACT.............................................................................................2

第一章 引言......................................................................................4

1.1研究背景………………………………………………………………..4

1.2文献综述………………………………………………………………..4

1.3本文的研究方法,意义和创新点……………………………………..6

第二章 相关理论和样本选取..........................................................6

2.1统计套利………………………………………………………………..6

2.2随机森林………………………………………………………………..7

2.3协整理论………………………………………………………………..7

2.4样本选取………………………………………………………………..7

第三章 选股策略..............................................................................8

3.1随机森林选股与传统选股步骤比较…………………………………..8

3.2随机森林选股策略……………………………………..……………....9

3.2.1 评价指标………………………………………………………...9

3.2.2 指标结果分析……………………………………………...…..10

3.3选股结果………………………………………………………………12

第四章 套利实证研究....................................................................12

4.1 协整套利研究………………………………………………………...12

4.1.1 单位根检验…………………………………………………...12

4.1.2 回归模型……………………………………………………...13

4.1.3 套利策略……………………………………………………...13

4.2 随机森林套利研究…………………………………………………...14

4.3 实证结果对比分析…………………………………………………...14

第五章 结论与展望.............................................................................15

5.1 结 论………………………………………………………………….15

5.2 展 望………………………………………………………..………...16

参考文献..........................................................................................17

致 谢................................................................................................19

相关图片展示:

课题毕业论文、开题报告、任务书、外文翻译、程序设计、图纸设计等资料可联系客服协助查找。